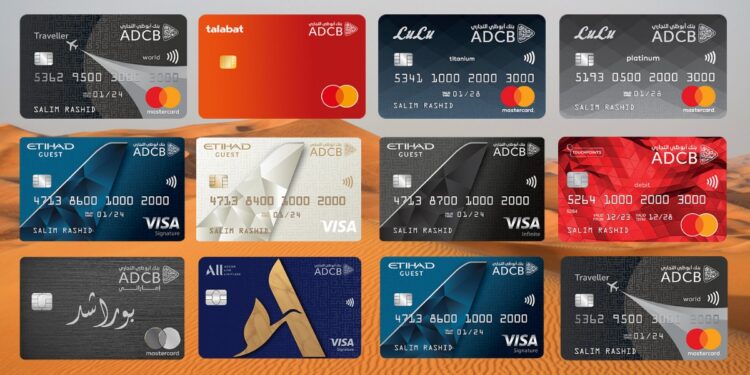

ADCB (Abu Dhabi Commercial Bank) offers a range of ADCB credit cards designed to meet various financial needs and lifestyles of residents in the UAE. From exciting rewards and exclusive discounts to global acceptance, ADCB credit cards provide numerous benefits.

This guide will walk you through everything you need to know about ADCB credit cards, including offers, application process, benefits, and more.

Key Highlights of ADCB Credit Cards

- ADCB credit card offers: Enjoy a plethora of discounts, cashback, and exclusive deals.

- ADCB credit card minimum salary: Understand the salary requirements to apply for an ADCB credit card.

- ADCB credit card apply: Learn the application process to get your ADCB credit card.

- ADCB credit card application status: Track the status of your credit card application.

- Talabat ADCB credit card: Special benefits with the popular food delivery service.

- ADCB credit card benefits: Explore the perks and advantages of having an ADCB credit card.

- ADCB credit card requirements: Know the eligibility criteria for ADCB credit cards.

- ADCB credit card free for life: Find out how you can get an ADCB credit card with no annual fee.

- ADCB credit card lounge access: Enjoy luxury airport lounges with your ADCB card.

- ADCB credit card movie offers: Get exclusive movie ticket deals with ADCB credit cards.

- How to cancel ADCB credit card: Steps to terminate your ADCB credit card.

- ADCB credit card loan: Leverage your ADCB credit card for personal loans.

Available Credit Cards under ADCB Credit Card

ADCB offers a variety of credit cards tailored to suit different lifestyles and financial needs. Below is an overview of each type of ADCB credit card, highlighting their key benefits and features.

Talabat ADCB Credit Card

Get amazing rewards and free deliveries on Talabat orders.

- 35% back on Talabat orders.

- Unlimited free delivery.

- AED 500 welcome bonus.

- Personalized card design.

- Lounge access at airports.

- Hotel discounts.

- Card loan and 0% interest plans.

Talabat ADCB Credit Card

Get amazing rewards and free deliveries on Talabat orders.

- 35% back on Talabat orders.

- Unlimited free delivery.

- AED 500 welcome bonus.

- Personalized card design.

- Lounge access at airports.

- Hotel discounts.

- Card loan and 0% interest plans.

Traveller Credit Card

Your perfect companion for travel savings and benefits.

- 20% off on flights and hotel bookings.

- AED 1,000 welcome voucher.

- 0% foreign currency fee.

- Free hotel stays and lounge access.

- Free golf and talabat discounts.

- Travel insurance.

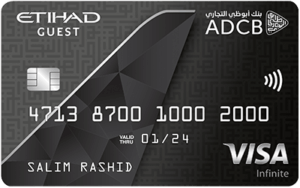

ADCB Etihad Guest Infinite Credit Card

Exclusive travel perks with Etihad Airways.

- 60,000 Etihad Guest Miles welcome bonus.

- 5,000 bonus Miles monthly.

- Fast-track to Etihad Guest Gold Tier.

- Lounge access and hotel discounts.

- Free golf and travel insurance.

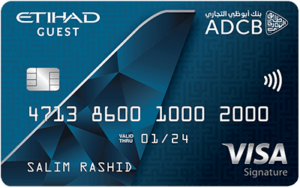

ADCB Etihad Guest Signature Credit Card

Enjoy special benefits with Etihad Airways.

- 35,000 Etihad Guest Miles welcome bonus.

- 2,000 bonus Miles monthly.

- Fast-track to Etihad Guest Silver Tier.

- Lounge access and hotel discounts.

- Free golf and travel insurance.

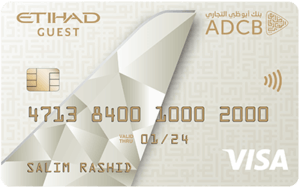

ADCB Etihad Guest Platinum Credit Card

Earn miles on all your purchases and fly more with Etihad.

- 12,000 Etihad Guest Miles welcome bonus.

- Earn up to 1.25 Etihad Miles per AED spent.

- 1,000 bonus Miles monthly.

- Hotel discounts.

- Purchase protection and extended warranty.

- Card loan and 0% interest plans.

Betaqti Credit Card

A premium card with unique lifestyle perks.

- Free gym access.

- Buy 1 Get 1 Free at VOX cinemas.

- 2-for-1 offers at Caribou Coffee.

- Metal card design.

- Lounge access.

- talabat discounts.

- International concierge and travel insurance.

Lulu Platinum Credit Card

Earn LuLu points on all your spending for daily savings.

- Up to 8 LuLu Points per AED spent.

- Free airport lounge access.

- Buy 1 Get 1 Free movie tickets.

- Dining and car ride discounts.

- 0% interest plans and card loan.

- Free for life.

Lulu Titanium Credit Card

Save with LuLu points and enjoy everyday benefits.

- Up to 3.5 LuLu Points per AED spent.

- Free airport lounge access.

- Dining and car ride discounts.

- 0% interest plans and card loan.

- Free for life.

TouchPoints Infinite Credit Card

Enjoy travel and lifestyle perks with exclusive offers.

- AED 1,200 worth of welcome vouchers.

- 15,000 TouchPoints bonus monthly.

- Buy 1 Get 1 Free movie tickets at VOX cinemas.

- Lounge access and free golf.

- International concierge and hotel discounts.

- Travel insurance.

TouchPoints Platinum Credit Card

Earn rewards and enjoy travel and lifestyle benefits.

- 10,000 TouchPoints bonus monthly.

- Buy 1 Get 1 Free movie tickets at VOX cinemas.

- 20% off on talabat orders.

- Free for the first year.

- Free golf and hotel discounts.

- 0% interest plans and card loan.

TouchPoints Titanium/Gold Credit Card

Earn TouchPoints on every purchase and redeem in many ways.

- 5,000 TouchPoints bonus monthly.

- Buy 1 Get 1 Free movie tickets at VOX cinemas.

- Lounge access.

- Free for life.

- Dining and hotel discounts.

- 0% interest plans and card loan.

You can compare different cards here

Key Offers by ADCB Credit Card

ADCB credit cards come with a variety of offers tailored to enhance your spending experience. From dining and travel to shopping and entertainment, ADCB has partnered with numerous merchants to provide exceptional discounts and rewards.

Popular Offers Include

- Dining Discounts

- Travel Rewards

- Retail Cashback

- Entertainment Deals

Talabat ADCB Credit Card

If you frequently order from Talabat, the Talabat ADCB credit card offers exclusive perks such as discounts on food orders, additional reward points, and more.

| Benefit | Description |

|---|---|

| Discounts on Talabat Orders | Enjoy up to 20% off on food orders made through the Talabat app. |

| Cashback Rewards | Earn up to 5% cashback on dining and grocery spends. |

| Extra Talabat Points | Earn additional Talabat points on every order, which can be redeemed for future purchases. |

| Welcome Bonus | Receive a bonus when you make your first purchase with the Talabat ADCB Credit Card. |

| Zero Annual Fee for the First Year | No annual fee for the first year; subsequent years may also be free if spending criteria are met. |

| Complimentary Airport Lounge Access | Access to over 25 lounges in the Middle East and 1000+ worldwide. |

| Buy One Get One Free Movie Tickets | Avail BOGO offers on movie tickets at participating cinemas. |

| Global Acceptance | Use your card at millions of locations worldwide. |

| 24/7 Customer Support | Dedicated customer service for all your needs and queries. |

| Purchase Protection | Enjoy insurance on purchases against theft or accidental damage. |

| Travel Insurance | Complimentary travel insurance for peace of mind during trips. |

Talabat ADCB Credit Card Requirements

| Requirement | Details |

|---|---|

| Minimum Salary | AED 5,000 per month |

| Age | Applicant must be at least 21 years old |

| Employment | Must be employed and able to provide proof of salary |

| Credit History | A good credit score is required for approval |

| Documents Needed | Emirates ID, Passport, Visa (for expatriates), Salary certificate, and recent bank statements |

| Residence | Applicants must be residents of the UAE |

| Initial Spend Requirement | Some offers and rewards may require an initial minimum spend to activate certain benefits. |

| Application Process | Can be completed online through the ADCB website or at a local ADCB branch. |

ADCB Credit Card Minimum Salary

To apply for an ADCB credit card, you need to meet the minimum salary requirement, which varies depending on the type of card. Here’s a quick overview:

- Standard Cards: The minimum salary requirement typically starts from AED 5,000.

- Premium Cards: For cards with enhanced benefits, the minimum salary requirement is usually higher, starting from AED 15,000.

Check the specific card details on ADCB’s website for precise requirements.

How to Apply for an ADCB Credit Card?

Applying for an ADCB credit card is straightforward. Follow these steps:

- Visit the ADCB Website: Navigate to the credit cards section.

- Select Your Card: Choose the card that suits your needs.

- Fill the Application Form: Provide your personal and financial details.

- Submit Required Documents: Attach necessary documents such as Emirates ID, passport, and salary proof.

- Submit Your Application: Apply online or visit the nearest ADCB branch.

Application Status

Once you’ve applied, you can check your ADCB credit card application status online or by contacting ADCB customer service. You will need your application reference number for this process.

Key Benefits

ADCB credit cards offer a wide array of benefits designed to make your financial management more rewarding and convenient.

Key Benefits Include

| Benefit | Description |

|---|---|

| Rewards Program | Earn points on every spend and redeem them for flights, hotel stays, or shopping vouchers. |

| Airport Lounge Access | Enjoy complimentary access to over 1000 airport lounges worldwide. |

| Movie Ticket Offers | Get two-for-one movie tickets and exclusive discounts at select cinemas. |

| Purchase Protection | Safeguard your purchases against theft or accidental damage. |

| Flexible Payment Options | Enjoy up to 55 days of interest-free credit. |

ADCB Credit Card Requirements

To qualify for an ADCB credit card, applicants must meet the following requirements:

| Age | Must be at least 21 years old. |

| Employment | Must be employed with a minimum salary as specified by the card. |

| Credit History | A good credit history enhances approval chances. |

| Documentation | 1. Emirates ID 2. Passport 3. Salary certificate 4. Bank statements |

ADCB Credit Card Free for Life

ADCB offers some cards with no annual fees, known as ADCB credit card free for life. These cards provide cost-effective solutions while still offering substantial benefits and rewards.

Special Perks of ADCB Credit Cards

ADCB credit cards are packed with exclusive perks, making them a valuable addition to your wallet.

Lounge Access

Frequent travelers will appreciate the ADCB credit card lounge access, providing comfort and convenience at airports across the globe.

Movie Offers

Movie buffs can enjoy ADCB credit card movie offers, including discounts and buy-one-get-one-free tickets at participating cinemas.

Managing Your ADCB Credit Card

Understanding how to manage your ADCB credit card effectively is crucial for maintaining financial health.

How to Cancel ADCB Credit Card?

If you need to cancel your ADCB credit card, follow these steps:

- Pay Off Outstanding Balance: Ensure your credit card balance is fully paid.

- Contact ADCB Customer Service: Inform them of your intent to cancel.

- Submit a Written Request: Provide a formal request for cancellation, either online or at a branch.

- Receive Confirmation: Wait for the official confirmation of cancellation from ADCB.

ADCB Credit Card Loan

ADCB credit cards also offer the flexibility of ADCB credit card loans. You can convert your credit limit into a loan with flexible repayment terms and competitive interest rates.

| Feature | Description |

|---|---|

| Flexible Loan Amount | Borrow up to 75% of your available credit limit, with amounts adjusted based on your card type and limit. |

| Easy Repayment Plans | Choose from a variety of repayment terms, typically ranging from 6 to 48 months, depending on your needs. |

| Competitive Interest Rates | Enjoy lower interest rates compared to standard cash advances or personal loans. |

| Quick and Easy Processing | Apply online or through the ADCB mobile app for a hassle-free loan approval process. |

| No Additional Documentation | Since you already have an ADCB credit card, there’s no need for additional documentation to process the loan. |

| Instant Fund Disbursement | Once approved, the loan amount is quickly transferred to your bank account. |

| Fixed Monthly Payments | Manage your budget easily with fixed monthly installments. |

| No Collateral Required | The loan is unsecured, meaning you don’t need to provide any assets as security. |

Frequently Asked Questions (FAQs)

What is the best ADCB credit card for frequent travelers?

The ADCB Platinum Travel Credit Card offers extensive travel rewards, including air miles, hotel discounts, and complimentary airport lounge access.

Can I apply for an ADCB credit card with a low salary?

Yes, ADCB offers credit cards with varying minimum salary requirements. The standard ADCB credit card requires a minimum salary starting from AED 5,000.

How do I earn rewards with my ADCB credit card?

You can earn rewards points on every spend, which can be redeemed for travel, shopping, dining, and more.

What should I do if I lose my ADCB credit card?

Contact ADCB customer service immediately to report the loss and prevent unauthorized transactions. They will assist you in blocking the card and issuing a replacement.

Are there any hidden fees associated with ADCB credit cards?

ADCB credit cards are transparent with their fees. However, it’s essential to read the terms and conditions of your specific card to understand all associated charges.

By choosing an ADCB credit card, you gain access to a world of benefits, rewards, and financial flexibility. Whether you’re a frequent traveler, a shopaholic, or someone looking for cost-effective credit solutions, ADCB has a card to suit your needs.

For more information or to apply for an ADCB credit card, visit the ADCB website.